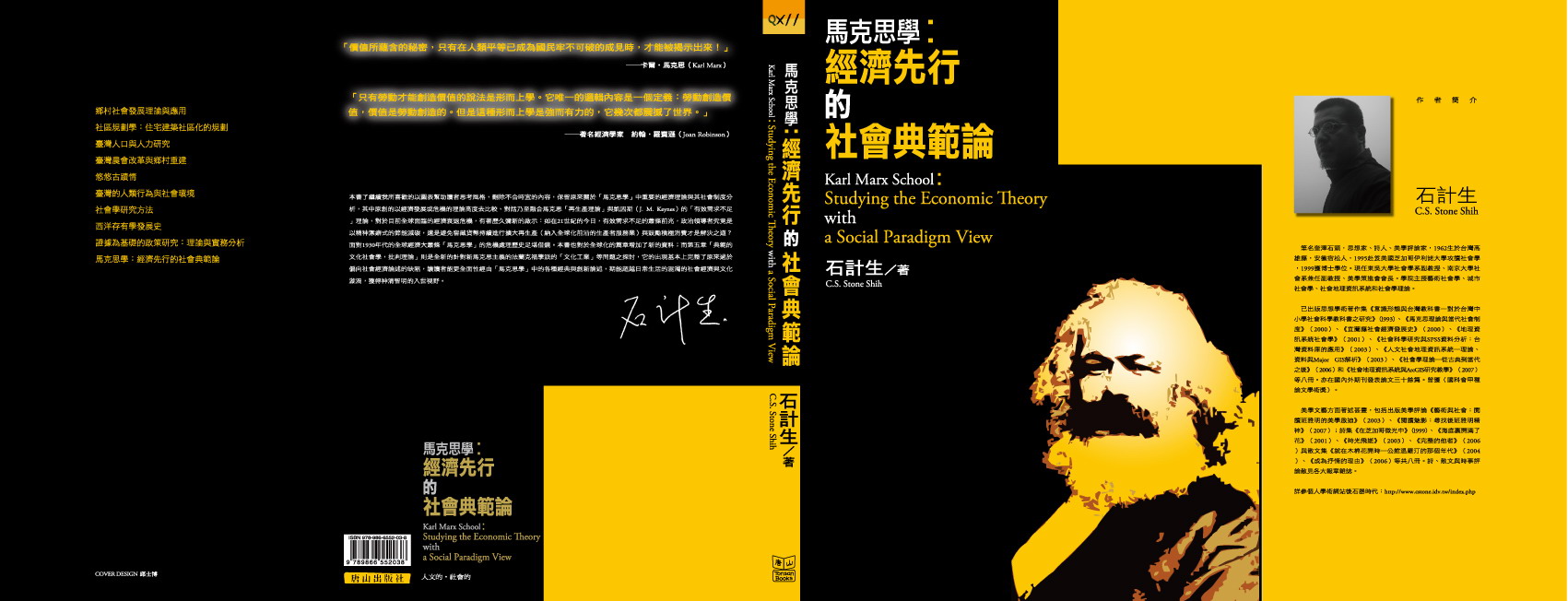

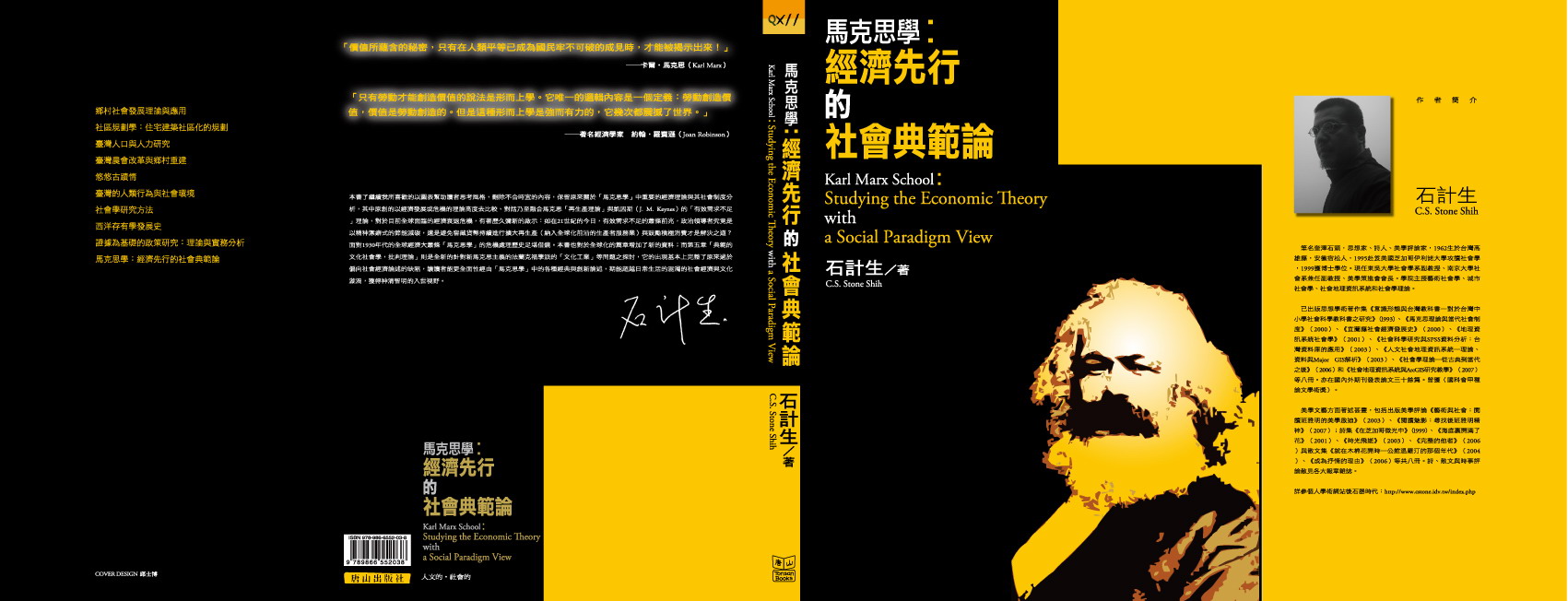

獻給恩師吳忠吉教授:石計生《馬克思學》2009年6月3日正式出版上市

詳見唐山出版社本書介紹:http://blog.yam.com/tsbooks/article/21372594

僅將本書

獻給我的恩師 台大經濟系吳忠吉教授(1946–2008)

石計生教授《馬克思學:經濟先行的社會典範論》唐山出版社版2009年新書上市(台北,2009.06.03)

人能常清靜,天地皆悉歸。 我命由我不由天。機在目。道法自然。 Since 1999

詳見唐山出版社本書介紹:http://blog.yam.com/tsbooks/article/21372594

僅將本書

獻給我的恩師 台大經濟系吳忠吉教授(1946–2008)

石計生教授《馬克思學:經濟先行的社會典範論》唐山出版社版2009年新書上市(台北,2009.06.03)

He observed certain characteristics about the growth and contractionary phase

of the long wave. Among them, he detailed the number of years that the economy

expanded and contracted during each part of the half-century long cycle, which

industries suffer the most during the downwave, and how technology plays a role

in leading the way out of the contraction into the next upwave.

The fifty to fifty-four year cycle of catastrophe and renewal had been known

and observed by the Mayans of Central America and independently by the ancient

Israelites. Kondratieff’s observations represent the modern expression of this

cycle, which postulates that capitalist countries tend to follow the long

rhythmic pattern of approximately half a century.

In the idealized long wave model, which is illustrated in the diagram above,

the cycle (which averages 54 years in length) begins with the “upwave” during

which prices start to rise slowly along with a new economic expansion. By the

end of a 25-30 year upwave period, inflation is running very high. Its peak sets

the stage for a deep recession that jolts the economy. The recession, which

begins about the time commodity prices break from their highs, is longer and

deeper than any that took place during the upwave.

1086993291.bmpEventually, though, prices stabilize and the economy recovers, beginning a

period of selective expansion that normally lasts nearly a decade. Referred to

as the secondary plateau, the expansion persists, giving the impression that

“things are like they used to be,” but its anemic nature eventually takes its

toll as conditions within the economy never reach the dynamic state that

occurred during the upwave. The secondary plateau ends with a sudden shock

(financial panic/stock market crash) and the economy rolls over into the next

contractionary phase, which is characterized by deflation and the start of an

economic depression.

[#M_ more.. | less.. |

The current revolution of the Kondratieff Wave began after the global economy

pulled out of a deflationary depression in the 1930s. Prices began to accelerate

upward after World War II, and reached the commodity price blowoff stage in

1980. Since that time, and then after the recession of 1990-1991 (much longer in

some locations such as California and Japan, the latter of which has never

really recovered from economic contraction), the global economy has been

treading the secondary plateau. During this period, consumers and investors

become aware that inflation is not accelerating Kondratieff Wave upward, and

disinflation becomes the buzz word. Paper assets such as stocks and bonds do

well since neither inflation nor deflation-both of which are damaging to stock

investment returns-hurts the marketplace.

But during the secondary plateau, the first signs of problems-the seeds of

the deflationary contraction soon to follow-become known. Isolated economies

fall into deflationary contraction, and telltale signs such as declining gold

prices begin to take hold. During the 1990s, it has been the Japanese economy

that slid first into deflationary contraction. Gold has already reached new

11-year lows and as yet shows no sign of a bottom.

The stock market crash of 1997 is the signal that the period of economic

growth along the secondary plateau is ending. Additional economies collapse and

plunge into deflationary contraction, as characterized during this revolution of

the Kondratieff cycle by the domino effect coming from Thailand, Indonesia,

Asia, and South America. Stronger economies such as those of Europe and North

America are likely to hang on until the last moment, then fall off into

deflationary contraction.

We can theorize at this time that these stronger economies, due to their

superior handling of monetary policy during the secondary plateau relative to

the countries that made serious enough mistakes to cause a plunge into serious

financial collapse, will not be affected as gravely as these other countries

with collapsing economies. However, no economy is exempt from the effects of the

contraction, which is felt worldwide.

Much controversy exists on whether the Kondratieff wave is valid for the post

WWII economy. Many have rejected it on the basis that the 54-year mark was

reached a decade ago, and should have been the trough. It can be argued,

however, that the start of the “up” cycle began in 1940 or 1945, rather than

1930. Also, life expectancy has increased in the 20th century. If the 54-60 year

cycle is based on generation aspects, then it would naturaly be ‘stretched’

beyond 60 years. Since these cycles of wars and economic birth and renewal occur

every 2-3rd generation, we can say that when the generation to last see a

depression dies off, it’s time for another cycle to begin.

The message of this revolution of the Kondratieff cycle, which is a cycle of

debt repudiation and not just of commodity price deflation (the deflation is

caused in part by defaulting debt and a contracting global monetary base, as we

have described in this report), is that humanity is much more aware of the

effects of the cycle than, say, in the 1930s, and that the contraction can be

handled. Although we have indicated that the masses have been in a state of

denial as to the likelihood that this type of economic collapse can actually

occur in this “new era,” as it always seems to be considered when the masses

fear the change from prosperity to economic contraction, awareness of the

problems that are becoming apparent and a recognition of the mistakes that were

made can serve to mitigate the contraction. When the y2k bug is factored in, we

can see that this collapse matches the Kodratieff trough. The great credit

bubble of the last 60 years will be washed away at the very trough predicted by

the Kondratieff wave.

However, two factors complicate the picture until this revolution of the

Kondratieff Cycle bottoms in 2003 when it can be expected that the collapsing

mound of debt will finally be cleaned out (enter y2k). First, European Union,

which takes its next step in 1999, represents a similar situation to that of

China’s assimilation of Hong Kong in that it represents a union of different

governments. Both the Western and Eastern worlds participated in the excess

speculation in Hong Kong leading up to the Crash of 1997. Falling government

constructs cause the masses to put too much faith in the free market, and excess

speculation results in a collapse. With European Union upcoming, changing

government structure to allow for a coordinated European economy has resulted in

too much investor confidence in the financial markets there, too. Thus, with the

Union coming right at the end of the Kondratieff Cycle, another financial market

collapse is likely to lead to a situation that gets worse before it gets better

there. In fact, precious resources required for y2k conversion are being

diverted to the ‘Euro’.

Second, Canada’s commodity-dependent economy presents an additional variable

to North America’s ability to withstand the forces of the deflationary

contraction now spreading across the globe. Although there will be periods of

rising commodity prices-perhaps the saving grace for economies such as Canada’s

(commodity and gold prices typically bottom right in the midst of the

deflationary contraction, as they did in 1932 at the depths of the Great

Depression)-this does complicate the picture with respect to anticipating Canada

and North America’s ability to “ride it out” with relatively little damage. In

fact, because we are so technologically dependant, we may suffer even more.

The Mayans were known for there intricate tracking of cycles such as this

one. By embracing the inevitability of the cycle, but not as a destiny but as a

tendency, they were able to mitigate its effects and emerge from the cycle

bottom in better condition that otherwise would have been possible. Will modern

humanity entering the 21st century take heed to the lessons of the past? We

certainly pray they do since a simple reality check is all that’s needed to

prevent the catastrophes now being seen in Asia and other countries.

http://www.angelfire.com/or/truthfinder/index22.html

_M#]

◎ 石計生

導 言

本書旨趣是對於以馬克思為核心的百年來參與辯論的各大思想家所環繞形成的「馬克思學」的理論典範研究。作者從歷史和社會變遷的角度詮釋馬克思的經濟與文化理論,其中他所建立在社會客觀價值的勞動、貨幣、資本和再生產的看法,使他的學說有著複雜的深意。作者認為,因為馬克思追求一種人類能夠處於絕對平等的社會,故當他談論經濟與社會文化的辯證關係時,是根據其集體解放的自由王國目的賦予整體性、價值、生產方式、階級、文化和未來共產社會言說的空間。

從結構來說:第一章描述「馬克思學」歷史理論得以成立的時間架構基礎。其演化色彩的社會學雖然和孔德(A. Comte),涂爾幹(E. Durkheim)一樣,皆立基於十九世紀實證主義的思潮和「朝向工業化轉變」(transition to industrialization)的時代問題;但本書從自然/歷史,結構/事件,重覆/預測,循環/線性各個時間面向和層次的具體分析顯示,馬克思的「螺旋時間」的辯證思考背景,使他的歷史唯物論超越同時代的理論侷限。作者在本章的討論側重直接援引馬克思著作和詮釋者的證據說明螺旋時間,並且強調由時間架構開展出來的馬克思「歷史理論是其經濟論述的一般理論」的本書基本立場。

第二章建構「馬克思學」典範。首先作者交待了馬克思的方法,辯證唯物論和整體性的概念息息相關的原因。然後,討論在馬克思方法下傳統的對於社會結構(基礎/上層建築)的詮譯,根據盧卡奇(G. Lukács)、盧森堡(R. Luxemburg)等人道馬克思主義的論點,在考慮螺旋時間,整體性,辯證法和動態的社會變遷後將二元擴充為更為精確的三元層次(基礎/階級/上層)內容。作者認為惟有這樣的「經濟先行的整體觀」才能完整表達馬克思典範的既能預測社會發展也能顯示社會結構和制度反覆出現的歷史必然性。在此,作者討論了馬克思對於生產力、生產關係、階級、意識形態等概念的看法,並從生產方式和社會型態的變遷的若干史實和詮譯這些概念所形構的馬克思典範對社會世界的具體把握,在時間的過程中它有著階段性的發展。同時,作者特別列舉「政治過程論」(Political Process Model)的當代社會運動理論的實例,和典範的動態變動作平行比較,藉以彰顯「馬克思學」的實踐意涵。

第三章探究「馬克思學」較為艱涉的經濟理論,涉及的各大經濟學家相當豐富,至少包括亞當斯密(A. Smith)、李嘉圖(D. Ricardo)、羅賓遜(J. Robinson)、希爾法亭 (R. Hilferding)、森島通夫(M. Morishima)、龐巴威克(Böhm-Bawerk)、斯拉法(P. Sraffa)和馬地克(P. Mattick)等。要釐清歷史必然性中人類的自由如何可能,馬克思認為關鍵在於價值的概念。它必須是能體現社會正義的客觀勞動價值,一個社會制度的設計應該朝向這個目前進(所以他用抽象的社會必要勞動時間作勞動衡量換算的基準,對剩餘價值的分配,價值/價格的轉形,財產所有權的公有化進行說明)否則的話,那必然是一個異化的,有剝削的經濟社會,資本主義社會就是馬克思的例子。作者在本章先從經濟史比較亞當斯密、李嘉圖、邊際效用學派,和馬克思對價值看法的異同,再提出馬克思的作為基礎經濟結構根本的勞動價值說,並論斷其缺點和貨幣資本的形成,接著根據馬克思《資本論》(Capital)原典,筆者對轉形問題,簡單再生產,擴大再生產和資本主義的經濟危機理論進行詮釋和探討。最後,將馬克思的經濟理論回歸歷史,說明變化社會中的勞動價值意義,所有的社會都可以有商品生產及勞動價值,但作者指出馬克思的想法是,只有資本主義社會的特殊生產方式(雇傭勞動,追求資本積累)其剝削的經濟關係才有剩餘價值問題和異化勞動問題。無階級的共產社會是一個廢除商品生產的世界,價值律不再作用,經濟現象的運作依靠生產者管理計劃經濟。

在舖陳了「馬克思學」典範的一般性(歷史理論)和特殊性(經濟理論)之後,第四章的重點作者放在當代社會制度的典範檢討。首先是對支配二十世紀的資本主義社會的考察。透過希爾法亭 (R. Hilferding)、、史威吉(P. M. Sweezy)、莎森(S. Sassn)、科司特(M. Castells)和阿多諾(T. W. Adorno)等論點,筆者提出三個簡潔的字眼:「全球化」、「壟斷資本」及「疏離」總括現代社會。其中企業規模擴及全球的合作與衝突,所有權制的無名化、民主化和公共化,經理階層興起與銀行信用制度的轉變造成當代生產方式的變態,在在形構成為今日的壟斷資本主義社會,它的生活面向的展現即是一個以享樂、消費為主的大眾社會。服務業既是它的主體,則多元化的階級在業已自動化、網路化的全球化社會從事各種勞動,異化在日常生活中成為時代的共同現象,作者藉上述三個字眼的內涵深度討論「馬克思學」典範的現實。進一步,筆者原創地透過對現代經濟學的奠基者凱因斯(J.M. Keynes)和馬克思的經濟危機理論比較,顯示馬克思經濟理論的時代應用意涵,並直接提出從長時段的社會變遷角度來看,經濟危機理論,凱因斯的方案在某種程度上可被視為馬克思理論的短期分析。福利國家的資本積累/合法性維持的矛盾使得失業、通貨膨脹諸問題仍未獲得解決,這種「混合經濟」的修補同樣也發生在社會主義國家的經濟改革。作者對於兩種社會制度的混合經濟表現的國家和政治型態有充分的釐清(從所有制和國家干涉的目的著手),並且經由科耐爾(J. Kornai)所謂的「短缺經濟」和澤蘭尼( István Szelényi) 等的「市場社會主義」論證了馬克思經濟理論的現實有著極其嚴重的缺失,它標示著史達林(Stalin)式中央計劃經濟的崩潰,也表示了市場價格機能的必要性。筆者也討論了齊克(Ota Sǐk)「第三條路」的社會主義經濟改革思潮的優缺點,「馬克思學」各大思想家與實踐家不懈的努力在於尋找公共福祉和個人營利平衡的整體。

第五章是「馬克思學」的文化研究。批判理論的先驅者盧卡奇在1923年寫的名著《歷史與階級意識》書中,描繪了他所預見的資本主義的物化(reification)世界及其危機:物化意識的產生在於:只有當個別商品問題不僅僅表現為個別的問題,也不是僅僅表現為按學科專業理解的經濟學的核心問題,而是表現為資本主義社會生活的各方面的核心的、結構的問題時,我們才可能達到這普遍性;因為只有在這種情況下,才能在商品關係的結構中發現資本主義社會的一切對象性形式和與此相應的一切主體形式的原形。而物化意識所瀰漫的物化世界內在於商品結構中的合理化形式,一種人造的「第二自然」被神秘化的自然規律,一種不依賴人的異於人的自律性來控制人的東西。這種自然規律遍及社會生活的所有表現,在人類歷史上第一次使整個社會隸屬於統一的經濟過程,社會所有成員的命運都由一些統一的規律來決定(Lukács, 1971)。「社會所有成員的命運都由一些統一的規律來決定」,這正是霍克海默(H. Horkheimer)、阿多諾(T. W. Adorno)和班雅明(W. Benjamin)等法蘭克福學派成員不論是在納粹的德國或流亡至美國紐約時所同時感受到的真實。法蘭克福學派繼承馬克思的「肯定性自由」,其自由和人的行動、實踐,與真實存在就是理性之間的基本矛盾,這人和實踐與人和理性間的矛盾,正是批判理論的以豐富理論嘗試去化解的過程,即使從現實效果來看多數的答案是偉大的失敗。

總結的地方筆者強調,二十世紀所發生的重大事件:如1914-1918、1939-1945年間的兩次世界大戰、法西斯和社會主義崛起、1930年代的全球經濟大蕭條、1960年代的學生運動和1970年代後網絡社會的崛起、1990年代的蘇聯解體和東歐巨變等,皆顯示「馬克思學」辯證關係在歷史的進程中不斷接受現實世界的驗證與影響,今日社會制度的經濟問題是世界問題,不管資本主義或社會主義制度,在二十一世紀都面臨嚴厲的考驗。但正如「馬克思學」當代學者德賽(M. Desai, 2002)所言,伴隨著這百年歷程的,是資本主義與社會主義的激烈鬥爭,以及這場鬥爭背後的經濟體制和發展模式的探索,還有自由主義的衰落與復興。其中最重要的現象,是「馬克思的復仇」(Marx’s Revenge):

「資本主義不是永恆的,資本主義也不是無法改變、創新和適應的。資本主義的侷限性必須從資本主義的最大優點所包含的不足中去尋找—也就是說,用辯證法去尋找。只有當資本主義不能進步時,它才會達到自己的極限。」

從資本主義歷史來看,在20世紀1930年代,「馬克思學」著名的經濟史家康德拉捷夫(N. D. Kondratieff)、熊彼德 (J. Schumpeter)及 曼德爾(E. Mandel)等不約而同提出了每隔約六十年左右會出現一次經濟大蕭條的「長波」假設。其經濟危機長波運動的根源,是在全球化的當代資本主義社會中,研究壟斷資本,企業聯合,世界市場的分合,戰爭,技術革命,網絡化程度,國際競爭對於工業生產的價值,利潤率,資本有機構成的影響,以得出經濟危機的長期累積的,前進的螺旋趨勢。其假設的預言在1930年代後約六十年的2008年的今日,全球性的經濟危機正蠢蠢欲動發生著。「馬克思的復仇」意味著當代全球化及其經濟衰退復活了馬克思的關於資本主義運動規律的經濟學思想,作者從經濟先行的社會整體論觀,指出了「馬克思學」作為一個社會學理論典範的意義和侷限。並且毫不諱言筆者對於馬克思螺旋演化的歷史終站:人人從事勞動自由的無階級社會的期待與嚮往,它當然是建立在資本主義高度發展耗盡自身能量成為自己掘墳人後退出歷史舞台,這樣的「馬克思學」的現實科學基礎上。從人類漫長的歷史而言,為資本所奴役的商品拜物社會有時而盡,消弭剝削和壓迫的勞動自由的未來世界需要我們以「馬克思學」的中軸–階級–人的力量參與社會結構變化共同努力。

(戊子炎夏於台北)

◎ 石計生

自 序

在對於流行商品的致命吸引力迷戀遠大於社會理論探討的今日世界,推出這樣一本嚴肅的學術性研究書籍,一開始顯得有點格格不入;但是,如果這樣一本書並非全然只是象牙塔裡的書空咄咄,而是能幫助人們從社會經濟理論和歷史,理解現實生活裡的困境的原因,則顯示了書籍作為一種思想之結晶的入世威力。這次我所寫的《馬克思學:經濟先行的社會典範論》是綜合各大家學說的以經濟結構、意識型態和階級所構成的三元辯證的「馬克思學」(Karl Marx School) 來進行資本主義經濟問題的結構性分析、社會運動、消費社會的文化理解和社會制度性的比較研究,基本上正是屬於這類裨益人們反思自己所處的社會的書籍。

事實上本書脫胎於八年前我所寫的絕版書籍《馬克思理論與當代社會制度》,過去多年來我在台北東吳大學上課,或至北京大學、清華大學與南京大學等學府講學理論之時,時常有學生或同好詢問關於本書再版事宜,但是因為種種原因無法實現。這次付梓機緣來自二00八年的一個春暖花開午後風簷展書讀報,一方面憂心於台灣本身的意識型態分裂、後現代消費文化所造成的集體智力下降和全球性的經濟衰退對於人們日常生活的影響,讓我決心要再出版;另一方面也因本書的問世獲得了社會科學專書出版聲譽卓著的台北唐山書店陳隆昊先生支持,遂開始針對這本對我過去二十幾年的「關於馬克思研究的思想總清算」書籍進行重新整理工作。整體來說,本書了繼續我所喜歡的以圖表幫助讀者思考風格,刪除不合時宜的內容,保留原來關於「馬克思學」中重要的經濟理論與其社會制度分析,其中原創的以經濟發展或危機的理論高度去比較、對話乃至融合馬克思「再生產理論」與凱因斯(J. M. Keynes)的「有效需求不足」理論,對於目前全球面臨的經濟衰退危機,有著歷久彌新的啟示:如在二十一世紀的今日,有效需求不足的蕭條前兆,政治領導者究竟是以精神潔癖式的節能減碳,還是避免窖藏貨幣持續進行擴大再生產(納入全球化前沿的生產者服務業)與鼓勵積極消費才是解決之道?面對1930年代的全球經濟大蕭條「馬克思學」的危機處理歷史足堪借鏡。本書也對於全球化的篇章增加了新的資料;而第五章「典範的文化社會學,批判理論」則是全新的針對新馬克思主義的法蘭克福學派的「文化工業」等問題之探討,它的出現基本上完整了原來過於偏向社會經濟論述的缺陷,讓讀者能更全面性經由「馬克思學」中的各種經典與創新論述,期能超越日常生活的混濁的社會經濟與文化漩渦,獲得神清智明的入世視野。

這此本書的完成要感謝我的學生黃映翎、曾顯惠和陳翊威等的耐心謄稿打字,唐山書店的編輯群的努力讓本書更好,與匿名審查本書的同行的寶貴意見。我誠摯希望讀者能從閱讀中受益,並最終能一起攜手實踐馬克思的「全世界人類的解放,繫於每一個人的自由獲得解放」的理想。

(2008.08)

站內相關閱讀:

◎ 神秘經驗紀事 http://www.cstone.idv.tw/index.php?pl=251&ct1=46

◎ 倫敦札記: http://www.cstone.idv.tw/index.php?pl=465&ct1=29